Categories > Loans

Top 8 Mortgage Brokers in Singapore

1. PropertyGuru Finance

Services: Refinancing services, home loans, commercial property loans, luxury property loans, private property loans

Website: https://www.propertyguru.com.sg/mortgage

Address: 1 Paya Lebar Link, #12-01/04 Paya Lebar Quarter, Singapore 408533

Contact Information: +65 8769 5300

Operating Hours: Monday to Friday, 9:00 am to 9:00 pm; Saturday, 9:00 am to 1:00 pm

| Google reviews score | 5/5 |

| Total reviews | 5/5 |

| Score consistency | 5/5 |

| Industry experience | 5/5 |

| ⮕Awards & certifications | 5/5 |

| ⮕Years in the industry | 5/5 |

| Scope of services | 5/5 |

| Communication & efficiency | 5/5 |

| Rates | 4.9/5 |

Pros

- Trusted rate comparison platform

- Rates are always up-to-date

Cons

- Closes relatively early on Saturdays

- Small team of brokers

PropertyGuru is a well-known real estate website dedicated to helping clients look and pay for their dream homes.

The subsidiary, PropertyGuru Finance, particularly focuses on helping clients find the best home loan rates with the help of trusted mortgage brokers in Singapore.

Having been in the industry since 2006, the team at PropertyGuru is well-versed in several aspects of home and property financing, especially with the fluctuating interest rates every year.

Clients who wish to buy a home can use the company’s property platform. In turn, mortgage brokers can give financial advice and search for the best home loan rates from major banks in Singapore.

We think the company makes owning a dream home more possible through excellent customer service and communication between the client and mortgage broker.

It’s a huge plus for us that the company will inform clients as early as four months of expiring lock-in periods.

We did notice that while the company has been around for a while, clients may have to work with a relatively small team of brokers, depending on their chosen lender.

Aside from working with trusted and professional mortgage brokers in Singapore, PropertyGuru provides clients with comprehensive rate comparison reports backed by smart technology.

This ensures that rates are always up to date, and if changes occur, the assigned mortgage broker will inform them about it.

The same process is applied to the company’s refinancing services, wherein clients will be informed of the best time to make changes to their loans.

If you wish to learn more about the company’s services or speak to a mortgage broker in Singapore, you can give them a quick call or message them via the mobile app or website.

Just take note that mortgage brokers operate on shorter hours on Saturdays. It may be best to schedule a meeting or call with your chosen broker ahead of time.

2. Mortgage Master

Services: Home loans, commercial property loans, financial management, refinancing

Website: https://mortgagemaster.com.sg/

Address: 39A Jalan Pemimpin, #02-00C Halcyon Building, Singapore 577183

Contact Information: +65 6974 7673

Operating Hours: Monday to Friday, 10:00 am to 7:00 pm

| Google reviews score | 5/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 5/5 |

| Score consistency | 5/5 |

| Industry experience | 4.8/5 |

| ⮕Awards & certifications | 4.8/5 |

| ⮕Years in the industry | 4.8/5 |

| Scope of services | 4.5/5 |

| Communication & efficiency | 5/5 |

| Rates | 5/5 |

Pros

- Suitable for first-time loan applicants

- Offers refinancing services

Cons

- Relatively late opening hours

- Limited range of services

The best mortgage brokers in Singapore offer affordable rates and easy communication. One of them is Mortage Master, a leading institution that puts your best interest first.

Communication is a vital factor when choosing the best mortgage brokers in Singapore. It’s crucial that clients fully understand the terms and conditions of their loans.

Mortgage Master is one of the best companies to start working with if you’re applying for a housing loan for the first time. The brokers put their best efforts into making your financing journey seamless.

Mortgage Master does this by prioritising transparency and clarity when explaining necessary jargon to clients. It’s one of the company’s defining features that we believe are worth noting.

With access to affordable loan rates across leading banks in the country, Mortgage Master’s efficient process handling and partnerships are testaments to their 50-year experience in the mortgage industry.

Aside from housing loans, the company also offers affordable rates for commercial property loans. You can get personalised loan advice on top of refinancing consultations for your next venture.

However, if you’re seeking more financial services from the company, Mortgage Master currently focuses on home and commercial property loans. Despite that, we still think the company’s expertise in these two fields is more than enough for first-time clients.

The company’s mortgage brokers can also help you choose which rate type you should choose according to your financial situation. It’s a huge plus for us that they pay attention to such details.

While you can easily book an online appointment with Mortgage Master, note the relatively late opening hours. If you wish to talk to a mortgage broker in person, we highly suggest making an enquiry or calling to ensure a broker will attend to your needs.

Overall, Mortgage Master is an excellent stepping stone for first-time clients seeking great home loan advice from industry experts.

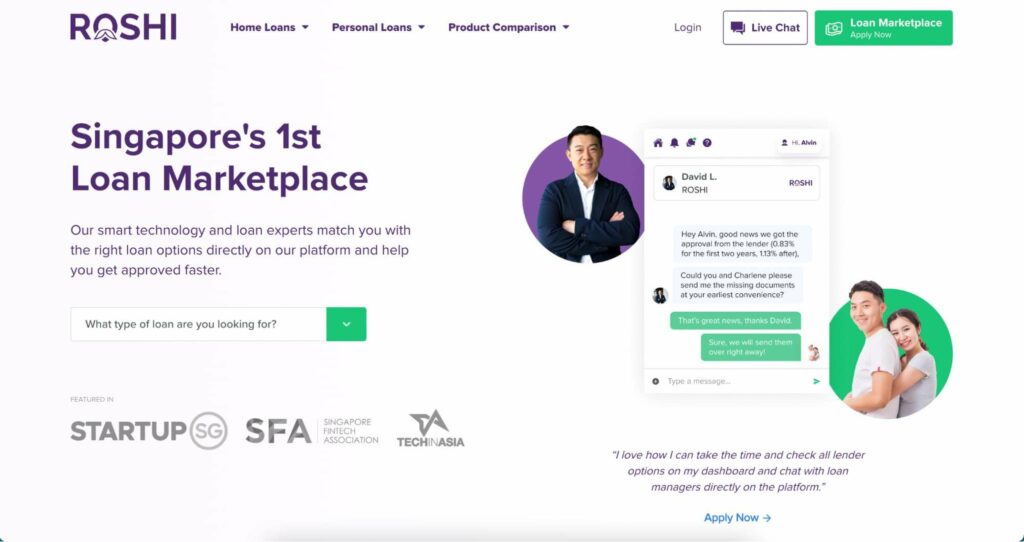

3. ROSHI

Services: Personal loans, debt consolidation planning, fast cash loans, car loans, wedding loans, renovation loans, home loans

Website: https://www.roshi.sg/

Address: 7 Temasek Boulevard, #12-07 Suntec Tower One, Singapore 038987

Contact Information: media@roshi.sg

Operating Hours: Open 24/7

| Google reviews score | 5/5 |

| Total reviews | 4/5 |

| Score consistency | 4/5 |

| Industry experience | 3.9/5 |

| ⮕Awards & certifications | 4/5 |

| ⮕Years in the industry | 3.8/5 |

| Scope of services | 5/5 |

| Communication & efficiency | 5/5 |

| Rates | 5/5 |

Pros

- Uses smart technology for its loan marketplace

- Offers customised loan options and financial strategies

Cons

- Not suitable for clients who want in-person meetings

- Not suitable for clients who aren’t tech-savvy

With a global shift towards using digital platforms for finance, ROSHI takes speed and convenience to another level. You can scout for the best rates on ROSHI’s loan marketplace.

With their online platform, clients get the benefit of comparing bank offers and rates from the comfort of their own homes. We love that ROSHI uses smart technology to provide quick and easy browsing through its interface.

Another great perk you may enjoy from ROSHI is its customised loan options you can optimise on a personal dashboard. Once your loan is approved, all the offers you applied for will be displayed there.

This makes for easy comparison and organisation when you want to apply for different loans from several banks.

Even if ROSHI is an online platform, you can still speak and discuss with the best mortgage brokers in Singapore through its messaging portal.

Here, you can ask for financial advice or consult about the different rates available on the platform. The mortgage broker assigned will help you understand the different terms and rates.

If you’ve already started on an application, ROSHI will then send you updates via chat, phone, or email. We’re particularly impressed by this feature since it builds credibility and trust between the mortgage broker and the client.

Since services are delivered online, in-person meetings with mortgage brokers are currently unavailable. This may prove troublesome to some clients who prefer face-to-face consultations or those who aren’t used to the online interface.

Nevertheless, the platform itself is quite simple to use. We still highly recommend ROSHI to both new and veteran clients.

4. KeyQuest Mortgage

Services: Home loan, commercial property loan, refinancing services, financial consultations

Website: https://keyquestmortgage.com.sg/

Address: 114 Lavender Street, #09-56 Lift Lobby 3, Singapore 338729

Contact Information: +65 9644 0186, contactus@keyquestmortgage.com.sg

Operating Hours: Monday to Friday, 9:30 am to 6:30 pm

| Google reviews score | 4.9/5 |

| Facebook reviews score | 5/5 |

| Total reviews | 4.8/5 |

| Score consistency | 4.5/5 |

| Industry experience | 4.25/5 |

| ⮕Awards & certifications | 4/5 |

| ⮕Years in the industry | 4.5/5 |

| Scope of services | 4/5 |

| Communication & efficiency | 4.5/5 |

| Rates | 4.6/5 |

Pros

- Partners with 18 major banks in Singapore

- No service charge for consultations

Cons

- Closed twice a week

- Small team of brokers

Getting financial advice from KeyQuest Mortgage involves unbiased service from dedicated mortgage brokers in Singapore. As an established company, the team works with a wide clientele.

The company partners with 18 major banks in the country. This gives you a better scope of what the market offers in terms of home loan rates.

Even better, the KeyQuest Mortgage team can help you compare and decide on your budget’s best possible loan rate.

The industry is loaded with jargon, and the company’s mortgage brokers can simplify them for you.

The team is well-trained and highly experienced in the field, so you can trust that by the end of your meetings, you’ll understand the terms and conditions of your loan.

Aside from receiving quality financial advice, KeyQuest Mortgage also offers refinancing services and assistance with business properties. If you’re interested in applying for a commercial property loan, the team can also devote their time to help you get started.

While the team is small, we noted how well they work to provide top-notch services to their clients. They can also promptly update you about any changes in rates for you to get ahead of your finances.

Even better, consultations are free of charge. This is an excellent perk for first-time clients seeking a new home or business.

If you’re interested in speaking to a mortgage broker in Singapore, we highly suggest calling them on weekdays since they’re closed twice a week.

Despite that, KeyQuest Mortgage is a solid choice for both first-time and returning clients seeking quality financial advice on home and business loans.

5. Mortgage Consultancy

Services: Industrial property loan, commercial property loan, home loan, bridging loan, fast cash loan

Website: https://www.mortgageconsultancy.com.sg/

Address: 47 Kallang Pudding Road, #09-08 The Crescent @ Kallang, Singapore 349318

Contact Information: +65 8556 5271, admin@mortgageconsultancy.com.sg

Operating Hours: Open 24/7

| Google reviews score | 5/5 |

| The Best Singapore | 4.4/5 |

| Total reviews | 4/5 |

| Score consistency | 4/5 |

| Industry experience | 4.8/5 |

| ⮕Awards & certifications | 4.8/5 |

| ⮕Years in the industry | 4.8/5 |

| Scope of services | 4.5/5 |

| Communication & efficiency | 4/5 |

| Rates | 5/5 |

Pros

- Client Referral Program available

- Many awards, certifications, and media features

Cons

- Investors Program is for select clients only

- Consults are free for homeowners

An important factor that Mortgage Consultancy takes into consideration when you’re applying for a home loan is wealth accumulation. The team not only focuses on finding the lowest rates but also on helping you progress with your assets.

The firm has a large team working to provide you with unbiased advice and access to major banks in the country. Brokers work together to help you get started on a seamless financial journey.

Like those in Mortgage Consultancy, mortgage brokers in Singapore work around the clock. If there’s a new rate in the market that they believe will benefit you, they will contact you about it.

We love that the firm is highly featured and recommended on sites like Yahoo Finance, Digital Journal, and FOX. This adds to its credibility as an established mortgage firm in Singapore.

Aside from home loans, the firm also offers its services to small and medium enterprise (SME) owners. If you’re planning on starting a business, the team can help you narrow down your options to the best rates possible.

While consults are highly personalised and comprehensive, they’re free for homeowners only. Clients seeking business loans may have to contact the firm about any charges for financial advice.

Refinancing is also a service the firm is known for. If you need advice on making the most out of your home loan, the team can simplify terms to make your loan journey seamless.

Another great feature is the Client Referral Program, where clients can get loyalty rewards. Building better relationships and growing your network with industry professionals is a nice touch.

The firm also offers resources for interested investors who want to learn more about the mortgage industry. However, this program is only available for select clients.

Despite that, Mortgage Consultancy is a great choice for clients who want to buy a new home and build their assets in the long run with the help of experienced professionals.

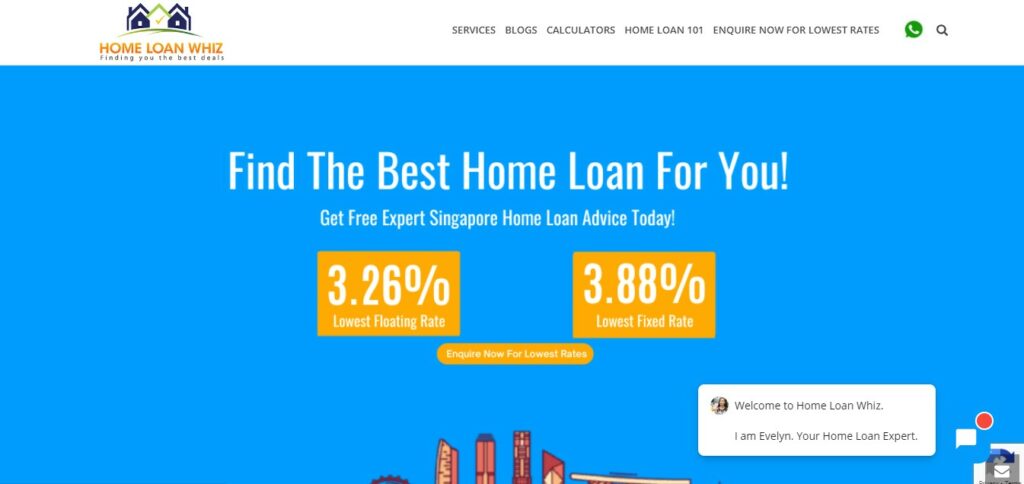

6. Home Loan Whiz

Services: Home loan, mortgage insurance, personal loan, commercial property financing, overseas property financing, in principle approval, total debt servicing ratio, business loans, conveyancing, home renovation loan

Website: https://homeloanwhiz.com.sg/

Address: 22-01 Golden Mile Tower, 6001 Beach Road, Singapore 199589

Contact Information:

Tel: +65 6631 8980

Fax: +65 6333 4636

Operating Hours: Everyday: 9:00 AM – 8:00 PM

| Google reviews score | 4.9/5 |

| The Best Singapore | 4.5/5 |

| Total reviews | 4.7/5 |

| Score consistency | 4.5/5 |

| Industry experience | 5/5 |

| ⮕Awards & certifications | 4/5 |

| ⮕Years in the industry | 5/5 |

| Scope of services | 5/5 |

| Communication & efficiency | 5/5 |

| Rates | 4/5 |

Pros

- Free advice

- Top notch service and personalized advice

- No hidden fees

- Quick response time

Cons

- Rates are not available on their website

Home Loan Whiz is one of the leading mortgage consultancy service companies in Singapore.

We think their team can best help you secure the perfect mortgage packages for you that’s available in the market.

This way, they’re able to save you a lot of time and money in the process.

What we like is that they offer a free advice to help you choose the best mortgage package from the over 20 banks they work with.

The reason why we’re recommending them is because their service is top-notch. They offer personalized advice, help you easily compare rates so you can get the best one, and there are no hidden fees for their service!

We like their quick response times as well since you can receive a reply within 24 hours.

Their team is absolutely fantastic and we, along with their other clients, can’t recommend them enough!

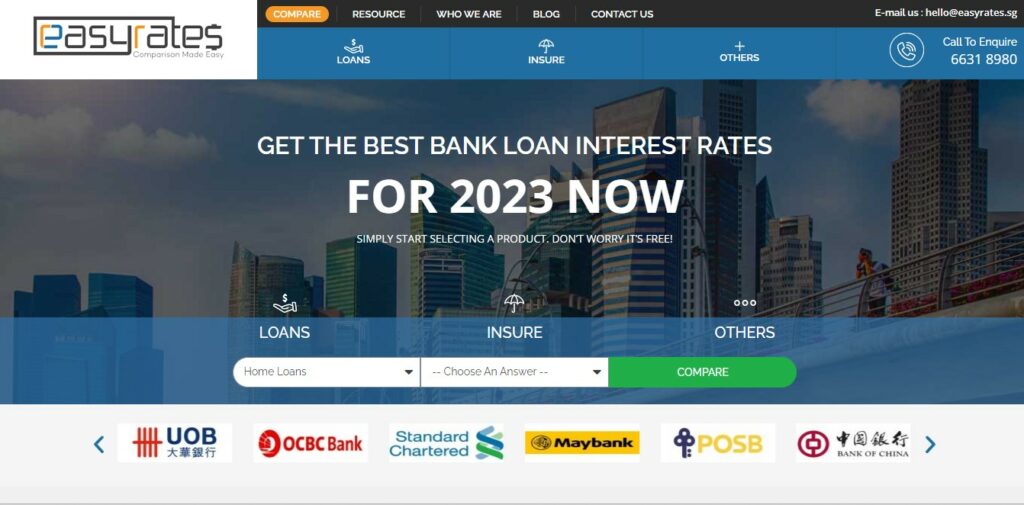

7. Easyrates

Services: Loans, insurance, conveyancing, crowdfunding, private banking

Website: https://easyrates.sg/

Address: 6001 Beach Rd, #22-01 GOLDEN MILE TOWER, Singapore 199589

Contact Information: hello@easyrates.sg | (+65) 6631 8980 (Main Line) | (+65) 9646 2498 (SMS/Whatsapp after office hours)

Operating Hours: Everyday: 9am – 7pm

| Google reviews score | 5/5 |

| The Best Singapore | N/A |

| Total reviews | N/A |

| Score consistency | N/A |

| Industry experience | 4/5 |

| ⮕Awards & certifications | 4/5 |

| ⮕Years in the industry | 4/5 |

| Scope of services | 5/5 |

| Communication & efficiency | 5/5 |

| Rates | 4/5 |

Pros

- Services include loans and insurance, conveyancing, crowdfunding, and private banking

- Partners with more than 20 banks from all over the country

- Independently operated and not owned or affiliated with any financial institutions

- Free loan/rate comparison services

Cons

- No information about their brokers on their website

Many turn to EasyRates when it comes to home loans, refinancing, equity loans, personal and business loans, insurance and investment matters.

Their services include various types of loans and insurance, conveyancing, crowdfunding, and private banking.

With more than 20 banks as partners from all over the country, they’ll allow you to receive offers from financial institutions all around the country for home loans, commercial property loans, overseas property loans, personal loans, business loans, insurance plans and investment products.

What we think gives them an edge is how they’re independently operated and not owned or affiliated with any financial institutions. Thus, you’re sure to receive 100% unbiased advice on all loans and financial products.

We like how their loan/rate comparison services are entirely free! You can easily use their online comparison tools and you’ll quickly receive offers.

Their service itself is amazing, too. They go above and beyond for their clients and we can’t help but recommend them!

8. Dollar Back Mortgage

Services: Home loans

Website: https://dollarbackmortgage.com/

Address: Contact for more information

Contact Information:

consult@dollarbackmortgage.com

+65 9298 6367

Operating Hours:

Mon – Fri: 10am – 8pm

Sat: 10am – 5pm

Sun & PH: Calls Only

| Google reviews score | 5/5 |

| The Best Singapore | N/A |

| Total reviews | N/A |

| Score consistency | N/A |

| Industry experience | N/A |

| ⮕Awards & certifications | N/A |

| ⮕Years in the industry | N/A |

| Scope of services | 4.5/5 |

| Communication & efficiency | 5/5 |

| Rates | 4/5 |

Pros

- Expert and professional team

- Shares various knowledge and information to their clients

- Excellent customer service

- Open/available daily

Cons

- No information about their brokers on their website

Dollar Back Mortgage is a company that was founded on the premise of providing mortgage specific knowledge and information when such have just been kept within the banking industry for a while.

We like how they make important information more available to the general public, and are able to help more people.

We’re agreeable to their belief that every individual has the right to know the pitfalls and loopholes of their home loans. This way they can advantage of the best home loan options available to them.

We think it’s also great that they stay away from just advising on the lowest interest rates.

They’re committed to providing other types of knowledge like the risks, macro-economic environment and interest rate trends both globally and domestically.

Their team is knowledgeable, patient and responsive every step of the way, making their clients feel like they can be trusted.

For many first-time buyers, they’ve helped them secure their homes without much worry and hassle. Their customer services is truly excellent.

We highly recommend!